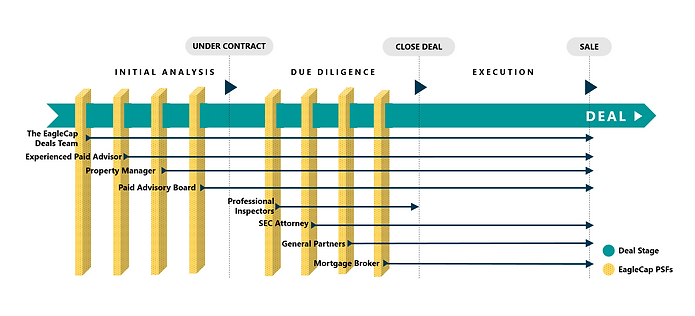

OUR PROCESS

EagleCap’s

Trusted Legacy Wealth System

Our proven system guarantees that each investment is supported by a comprehensive and strategic approach.

01

EagleCap Professional Screening Filter

Our rigorous screening process ensures that only 2%–3% of offerings in our targeted U.S. markets proceed to further review. We prioritize assets that meet our conservative underwriting and maximize cash flow for investors. We emphasize markets with strong employment and population growth across the U.S. On-site, our experts thoroughly inspect financials and property conditions to mitigate potential risks and identify opportunities for our investors. Only qualified deals move forward.

02

EagleCap Expert Project Operations

Our systematic team approach to performance, KPIs, and people consistently elevates our apartment communities to the highest standards, ensuring predictable investor cash flow and property appreciation, leading to substantial payouts. Our strategy includes addressing deferred maintenance and upgrading units upon turnover to increase rents. Additionally, we partner with skilled third-party property managers to improve operations and reduce operating expenses.

03

EagleCap Maximum Return Strategy

Our strategy focuses on maximizing cash flow and profits while stabilizing and maintaining the asset, to position for a profitable exit. Stabilized, cash-flowing properties are attractive to institutional buyers, including REITs and investment firms. While we typically plan a 5-7 year exit, we may hold properties long-term for cash flow, or sell earlier, if conditions are favorable. Once stabilized, we may refinance to return investor capital. This approach allows our investors to benefit from returns while positioning them for future opportunities with EagleCap’s next acquisition.

ASSET ACQUISITION CRITERIA

Exceptional Quality | Exceptional Returns

CAP Rate

At Purchase: Calculated based on current financials, accounting for potential value-add opportunities.

At Sale: The business plan typically projects a conservative 0.1% annual increase for each year held.

General Criteria

High-yield income potential.

Steadily cash flowing.

Focus on value-add opportunities.

Asset Type & Location

B+ to C+ class multifamily properties; prefer B class in A markets and C+ class in B markets.

Target Return & Investment Period

Annual Cash-on-Cash Return: 5%–10% (based on current financials).

Total Annual Return (AAR): 13%–18% over the investment period.

Hold Period: 5–7 years (medium to long-term).

Minimum Units

50+ units, with a preference for 100+ units

Occupancy

Prefer stabilized properties with a minimum of 85% occupancy but will consider lower if the property is well-located and offers value-add potential.

Age

Preference for properties built in 1978 or later, though older properties may be considered.

Transaction Size

$1M - $50M

Roofs

Pitched roof construction preferred, though not required.

Target Markets

Nationwide growth markets.

Premier Properties

Well-located properties with strong value-add potential are preferred, though stabilized properties with minimal deferred maintenance are also considered.

Utilities

Individually metered units are preferred.

EagleCap Asset Protection

At EagleCap Legacy Wealth Partners, we prioritize asset protection in all our deals. We work closely with SEC attorneys to establish the necessary organizational structures, including LLCs and Private Placement Memorandums (PPM). Our PPM offers two types of shares:

Member Shares (LP shares): For passive investors (Limited Partners) who contribute capital and receive periodic cash flow distributions. LPs take a completely passive role.

Manager Shares (GP shares): For active deal sponsors (General Partners) who manage the asset from acquisition to disposition and share in the general partnership (GP).

This structure ensures proper governance and documentation, guiding our decision-making and protecting assets.

Did you know you can use your retirement funds to invest in real estate?

Many people are unaware that they can use retirement funds from their Roth IRA, Traditional IRA, or 401(k) to invest in real estate. Traditional brokers often don’t allow these types of investments, limiting your options. Fortunately, we’ve built strong partnerships with reputable Self-Directed IRA and Solo 401(k) providers. These experts can guide you through transferring funds from your IRA or 401(k) into a qualified account. Once set up, you can use those funds to partner with us in real estate deals.